The public accounts of the Portuguese state in the 1920s were the main cause (and not merely ideological reasons, as is broadly defended in Portuguese public opinion) for the deep crisis of the 1920s in Portugal. Its public finances had been sustained by the financial cushion of the Overseas territories since 1893, a cushion that was interrupted by the conflict until 1931-32, when the issue of financial transfers from Angola to the Metropolis was fully normalized. At that time, the balance of Portuguese finances began to take shape, with Oliveira Salazar and Armindo Monteiro starting to work on it from April or May 1928 (well before the Wall Street crash). Their measures largely involved resolving the Angolan issue and the exchange rate problems in Mozambique.

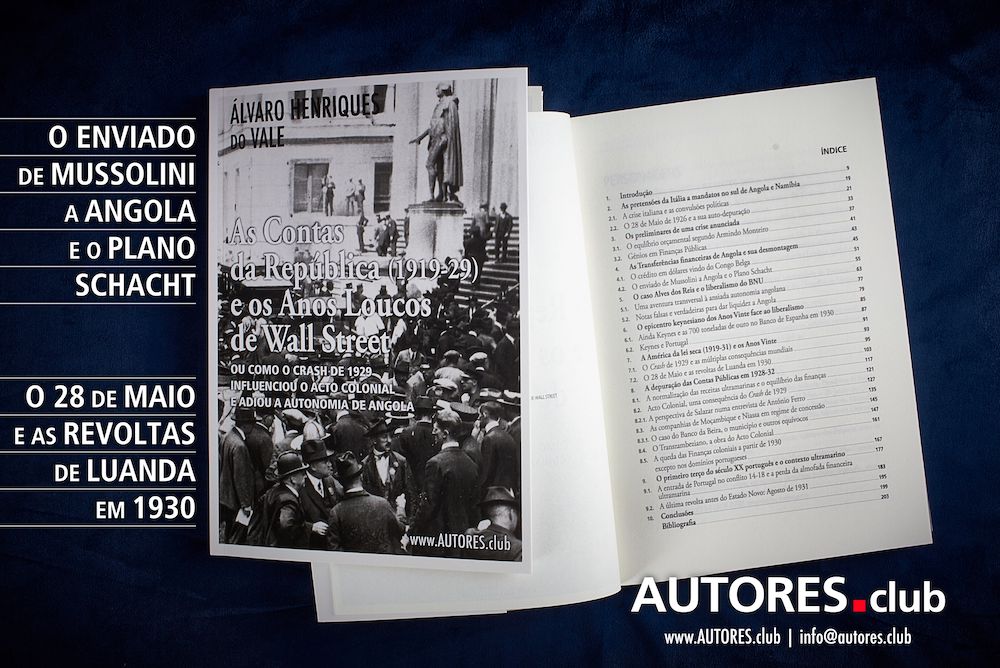

Author: Álvaro Henriques do Vale

Publisher: Perfil Criativo - Edições

Publication Date: November 2020, 1st edition

ISBN: 978-989-54702-9-7

SECURITY

SECURITY

AUTORES.club uses security measures.

DELIVERIES

DELIVERIES

Portugal: 4 days; Europe: 10 days; Rest of the world: 20 days.

RETURNS

RETURNS

You can return your order within 14 days.

(+351) 214,001,788 | encomendas@autores.club

Order from a store near you.

Fnac | Worten | Wook | Bertrand | Promobooks

The various reformist governments before May 28 kicked the issue down the road, trying to recover the aforementioned financial cushion and postpone Angola's autonomy, scheduled by the League of Nations, for as long as possible, while maintaining a Portuguese presence. However, the climate of factional strife among political parties and the lack of a Portuguese banking system capable of handling the situation... led to profound instability at all levels of Portuguese society, which Raúl Brandão and Teixeira de Pascoaes captured in their play "Jesus Christ in Lisbon." The Republic, under the influence of England, would certainly have to veer to the right, following the model of Miguel Primo de Rivera's military dictatorship. It was in England's interest to have a peaceful Iberian Peninsula, considering its geostrategic interests in Gibraltar, Malta, and Cyprus, on the route to the Suez Canal and India.

When, in 1919, America bought Belgium's public debt, Belgium provided guarantees by granting Americans privileges in the Belgian Congo, which facilitated capital flow in that African region through the dollar, which, after the First World War, replaced the British pound as the standard currency. The strong economic relief in the Congo had a domino effect in Angola, triggering a race for credit concessions from the Banco Nacional Ultramarino (BNU), which in 1919 opened a branch in Leopoldville (Kinshasa). This occurred just as the newly-founded League of Nations had recommended to the Portuguese Republic that Angola be granted autonomy. It was easier to obtain dollars in Luanda (than in Lisbon) via the Belgian Congo.

In light of the BNU’s leniency, fictitious companies were formed in Portuguese territory to access indiscriminate credit without the need for guarantees, as Armindo de Sttau Monteiro noted. The countdown began for the advent of May 28, a movement that sought to immediately address the problem of financial transfers from Angola to the Metropolis and prepare for autonomy that would ensure a Portuguese presence. However, in October 1929, the Wall Street crash put an end to all Angolan autonomy illusions, leading to harsher measures by the Military Dictatorship through the legislation of the Colonial Act.